Medicare and Medicare Advantage

Tuesday October 15, 2024 - Jennifer Prell

Original

Medicare

Medicare is a federal

health insurance for anyone age 65 and older, and some people under 65 with

certain disabilities and conditions. Medicare covers the cost of treatment in

public hospitals, medical services, and medications. There are supplements available

to help cover the costs not covered by traditional Medicare. You can go to a

doctor anywhere in the United States, as long as the provider accepts Medicare.

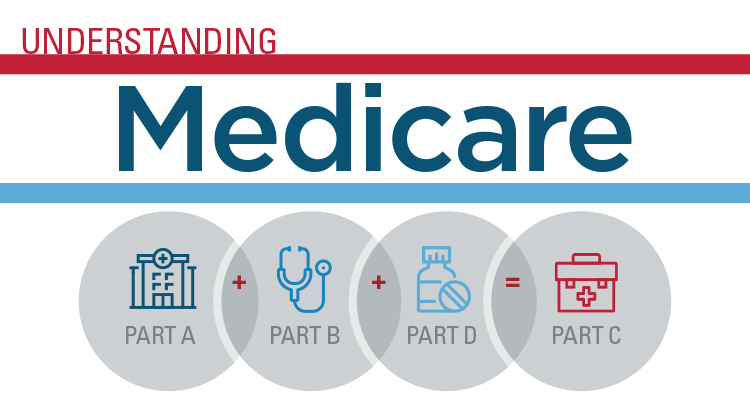

To receive full

coverage through original Medicare, you’ll likely have to enroll in four

separate plans:

- Part A - Covers hospitalization

- Part B - Covers doctor visits and

outpatient services

- Part D - Prescription drug plan

The federal

government sets the premium, deductible and coinsurance amounts for Parts A and

B. For example, most people pay $174.70 a month in 2024 for the Part B

premium, and they’re typically responsible for a $240 yearly deductible and 20

percent of the cost of doctor visits, lab tests and other outpatient services.

Most people

don’t have to pay a premium for Part A hospitalization. But they must pay a

$1,632 deductible for each benefit period they use in 2024, which could amount

to more than one period in a year if you face several hospitalizations, and a

$408 daily copayment for days 61 to 90 in the hospital per benefit period.

The government

also sets maximum deductibles for the Part D prescription drug program. In

2024, Part D deductibles can’t be greater than $545, but plans can have lower

or no deductibles. The premiums and cost sharing vary by plan.

Medicare

Advantage (MA) is NOT Medicare rather private insurance through health

insurance providers. When you purchase MA you decline traditional Medicare.

These plans have networks of providers usually based in specific geographic

areas. Your options may be limited in some areas.

Enrollees must

pay the Part B premium, which is $174.70 a month in 2024 for most people, as

well as any Part A premiums if they aren’t eligible for free coverage. They may

have to pay a monthly Medicare Advantage premium, too, although more than half

of the plans don’t charge additional premiums. Enrollees typically are required

to pay copayments for a hospital stay and copayments or coinsurance for Part B

services, such as doctor visits and X-rays.

Medicare

Advantage

Plans have an annual cap on out-of-pocket expenses, which include deductibles

and copayments but not premiums. In 2024, the limit is $8,850 for in-network

services although some plans have lower caps. If you choose a Medicare

Advantage PPO, the limit is $13,300 for using a combination of in- and

out-of-network services.

People on

Medicare Advantage (MA) plans have a once in a lifetime opportunity

to get out of their MA plan and go back onto traditional Medicare during Open

Enrollment. Applicants do not have to answer the medical questions to apply for

the new traditional plan People can only do this ONE TIME.

If you are interested in speaking with a broker, please reach out to Elderwerks for a complimentary referral. These brokers will inform you of the insurance best for you. If you want to purchase through them that's fine, but they are educators as well.

Speak Your Mind

Please to post comments.